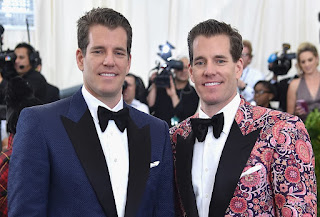

Winklevoss Twins Implement Leaderboard Tactic on Gemini to Boost Derivatives Exchange. By Laurie Suarez www.crypto101bylauriesuarez.com

Date: July 28, 2023

In a strategic move to enhance user engagement and drive adoption of their derivatives exchange, the Winklevoss twins have implemented a Leaderboard tactic on their cryptocurrency trading platform, Gemini. The introduction of this innovative feature is poised to transform the way traders interact with derivatives and could potentially solidify Gemini's position as a leading platform in the fast-evolving cryptocurrency derivatives market.

The Winklevoss Twins' Vision for Gemini

Since its inception, Gemini, founded by the Winklevoss twins, Cameron and Tyler Winklevoss, has been at the forefront of fostering a trustworthy and regulated environment for cryptocurrency trading. The exchange's commitment to adhering to strict regulatory standards has earned it a reputation as a reliable platform for both institutional and retail investors.

However, with the cryptocurrency market's continuous evolution, Gemini recognized the need to innovate and expand its offerings. To meet the demands of their growing user base, the Winklevoss twins set their sights on the derivatives market, which has seen substantial growth in recent years.

The Rise of Cryptocurrency Derivatives

Cryptocurrency derivatives have emerged as a popular financial instrument, enabling traders to speculate on the price movements of digital assets without owning them directly. These financial products include futures contracts, options, and perpetual swaps, providing traders with a range of strategies to hedge risk or seek profit opportunities in the volatile crypto market.

The demand for cryptocurrency derivatives has been driven by both retail and institutional traders seeking exposure to the crypto market while managing their risk effectively. As the adoption of cryptocurrencies continues to grow, derivatives exchanges have become a critical component of the overall cryptocurrency ecosystem.

1. Increased User Engagement:

The Leaderboard adds an element of competition and excitement to the trading experience, motivating users to trade actively and explore different strategies to climb the rankings. As a result, user engagement on the derivatives platform is likely to increase significantly.

2. Attraction of High-Volume Traders:

By offering rewards and recognition to top-performing traders, Gemini can attract high-volume traders seeking incentives for their trading activities. These traders can bring liquidity to the platform and contribute to a more vibrant trading ecosystem.

3. Enhanced Liquidity:

A more engaged and active user base can lead to improved liquidity on the derivatives exchange. Higher liquidity can, in turn, reduce trading costs and slippage for all users, making the platform more attractive to both retail and institutional traders.

4. Community Building:

The Leaderboard fosters a sense of community among traders on Gemini, creating opportunities for knowledge-sharing and networking. A strong community can contribute to the platform's reputation as a supportive and collaborative trading environment.

5. Data Insights:

By analyzing the trading behaviors of top-ranked traders, Gemini can gain valuable insights into market trends, popular strategies, and user preferences. These insights can inform the platform's decision-making and help tailor services to meet users' needs.

Conclusion

The implementation of the Leaderboard tactic on Gemini's derivatives exchange by the Winklevoss twins is a strategic move that has the potential to transform the way traders interact with cryptocurrency derivatives. By introducing gamification and incentives, the Winklevoss twins are aiming to boost user engagement, attract high-volume traders, and build a strong trading community on the platform.

As the cryptocurrency market continues to evolve, derivative products play an increasingly crucial role in providing diverse trading opportunities. With the introduction of the Leaderboard, Gemini is well-positioned to capture a significant share of this growing market and further solidify its status as a leading and innovative player in the cryptocurrency exchange ecosystem.

In a strategic move to enhance user engagement and drive adoption of their derivatives exchange, the Winklevoss twins have implemented a Leaderboard tactic on their cryptocurrency trading platform, Gemini. The introduction of this innovative feature is poised to transform the way traders interact with derivatives and could potentially solidify Gemini's position as a leading platform in the fast-evolving cryptocurrency derivatives market.

The Winklevoss Twins' Vision for Gemini

Since its inception, Gemini, founded by the Winklevoss twins, Cameron and Tyler Winklevoss, has been at the forefront of fostering a trustworthy and regulated environment for cryptocurrency trading. The exchange's commitment to adhering to strict regulatory standards has earned it a reputation as a reliable platform for both institutional and retail investors.

However, with the cryptocurrency market's continuous evolution, Gemini recognized the need to innovate and expand its offerings. To meet the demands of their growing user base, the Winklevoss twins set their sights on the derivatives market, which has seen substantial growth in recent years.

The Rise of Cryptocurrency Derivatives

Cryptocurrency derivatives have emerged as a popular financial instrument, enabling traders to speculate on the price movements of digital assets without owning them directly. These financial products include futures contracts, options, and perpetual swaps, providing traders with a range of strategies to hedge risk or seek profit opportunities in the volatile crypto market.

The demand for cryptocurrency derivatives has been driven by both retail and institutional traders seeking exposure to the crypto market while managing their risk effectively. As the adoption of cryptocurrencies continues to grow, derivatives exchanges have become a critical component of the overall cryptocurrency ecosystem.

The Leaderboard Tactic

The Leaderboard tactic implemented by the Winklevoss twins on Gemini introduces a competitive element to the derivatives trading experience. By gamifying the trading process, the Leaderboard rewards users based on their trading performance and achievements, creating an incentive for traders to actively participate in the derivatives market.

Here's how the Leaderboard tactic works on Gemini:

Real-time Rankings: Traders are ranked in real-time based on their trading volume, profits, and other key performance metrics. These rankings are updated regularly, creating a dynamic and engaging leaderboard.

Rewards and Recognition: The top-performing traders on the Leaderboard are rewarded with various benefits, such as reduced trading fees, exclusive access to new features, and even opportunities for collaboration with Gemini on future initiatives.

Social Interaction: The Leaderboard encourages social interaction among traders. Users can follow each other's progress, share strategies, and learn from top traders' insights, creating a sense of community within the platform.

Educational Value: The Leaderboard also serves an educational purpose, as it allows less experienced traders to observe the trading strategies and behaviors of successful participants, potentially improving their own trading skills.

The Leaderboard tactic implemented by the Winklevoss twins on Gemini introduces a competitive element to the derivatives trading experience. By gamifying the trading process, the Leaderboard rewards users based on their trading performance and achievements, creating an incentive for traders to actively participate in the derivatives market.

Here's how the Leaderboard tactic works on Gemini:

Real-time Rankings: Traders are ranked in real-time based on their trading volume, profits, and other key performance metrics. These rankings are updated regularly, creating a dynamic and engaging leaderboard.

Rewards and Recognition: The top-performing traders on the Leaderboard are rewarded with various benefits, such as reduced trading fees, exclusive access to new features, and even opportunities for collaboration with Gemini on future initiatives.

Social Interaction: The Leaderboard encourages social interaction among traders. Users can follow each other's progress, share strategies, and learn from top traders' insights, creating a sense of community within the platform.

Educational Value: The Leaderboard also serves an educational purpose, as it allows less experienced traders to observe the trading strategies and behaviors of successful participants, potentially improving their own trading skills.

The Impact on Gemini's Derivatives Exchange

The introduction of the Leaderboard tactic on Gemini's derivatives exchange is expected to have several positive impacts on the platform and its user base:

The introduction of the Leaderboard tactic on Gemini's derivatives exchange is expected to have several positive impacts on the platform and its user base:

1. Increased User Engagement:

The Leaderboard adds an element of competition and excitement to the trading experience, motivating users to trade actively and explore different strategies to climb the rankings. As a result, user engagement on the derivatives platform is likely to increase significantly.

2. Attraction of High-Volume Traders:

By offering rewards and recognition to top-performing traders, Gemini can attract high-volume traders seeking incentives for their trading activities. These traders can bring liquidity to the platform and contribute to a more vibrant trading ecosystem.

3. Enhanced Liquidity:

A more engaged and active user base can lead to improved liquidity on the derivatives exchange. Higher liquidity can, in turn, reduce trading costs and slippage for all users, making the platform more attractive to both retail and institutional traders.

4. Community Building:

The Leaderboard fosters a sense of community among traders on Gemini, creating opportunities for knowledge-sharing and networking. A strong community can contribute to the platform's reputation as a supportive and collaborative trading environment.

5. Data Insights:

By analyzing the trading behaviors of top-ranked traders, Gemini can gain valuable insights into market trends, popular strategies, and user preferences. These insights can inform the platform's decision-making and help tailor services to meet users' needs.

Conclusion

The implementation of the Leaderboard tactic on Gemini's derivatives exchange by the Winklevoss twins is a strategic move that has the potential to transform the way traders interact with cryptocurrency derivatives. By introducing gamification and incentives, the Winklevoss twins are aiming to boost user engagement, attract high-volume traders, and build a strong trading community on the platform.

As the cryptocurrency market continues to evolve, derivative products play an increasingly crucial role in providing diverse trading opportunities. With the introduction of the Leaderboard, Gemini is well-positioned to capture a significant share of this growing market and further solidify its status as a leading and innovative player in the cryptocurrency exchange ecosystem.

Comments

Post a Comment